Questions and Answers > SHOPEE CHEGG ryoraihan717@ gmail. com LINK 2.docx Airlangga University KLK SDASDASD

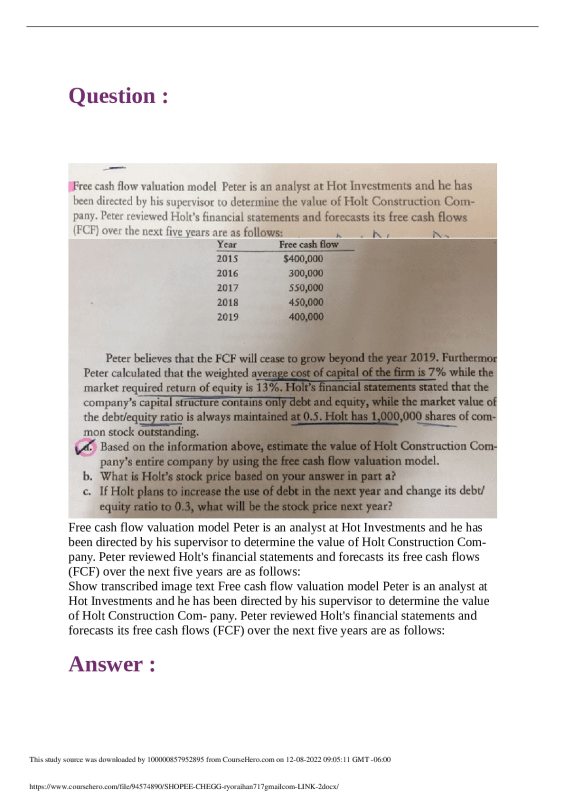

Airlangga University KLK SDASDASD Question : Free cash flow valuation model Peter is an analyst at Hot Investments and he has been directed by his supervisor to determine the value of Holt Construction Company. Peter reviewed Holt's financial statements and forecasts its free cash flows (FCF) over the next five years are as follows: Show transcribed image text Free cash flow valua ...[Show More]

Preview 1 out of 2 pages

Reviews( 0 )

| Category: | Questions and Answers |

| Number of pages: | 2 |

| Language: | English |

| Last updated: | 1 year ago |

| Downloads: | 2 |

| Views: | 0 |