Quiz > Derivatitives q 6 final

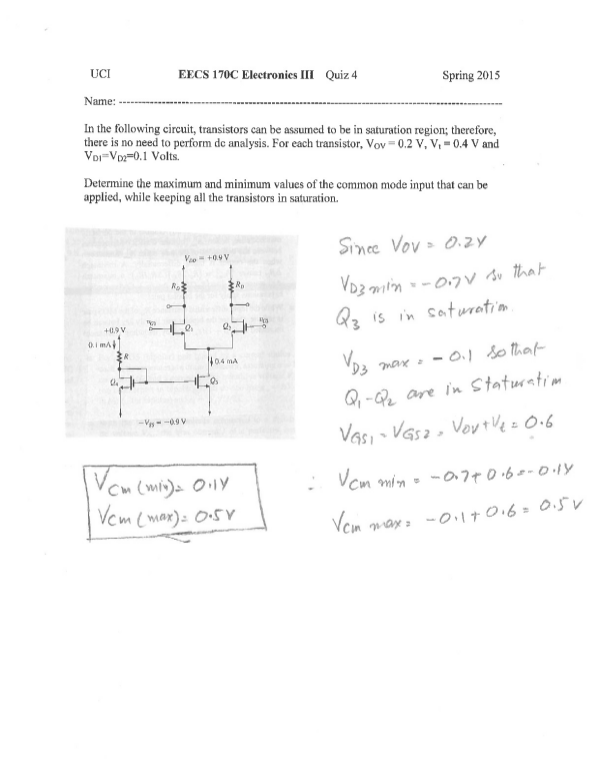

Western Sydney University DERIVATIVE 200079 6. Using the two-step binomial option pricing model calculate the price for a 1 year American PUT option for a stock trading at $120.00 today, under the following market conditions • The continuous compounded risk free rate is 2.4693%Da • The strike price is $123.45 The volatility of the stock ...[Show More]

Preview 1 out of 2 pages

Reviews( 0 )

| Category: | Quiz |

| Number of pages: | 2 |

| Language: | English |

| Last updated: | 3 weeks ago |

| Downloads: | 1 |

| Views: | 0 |