Baruch College, CUNY

REES 3400

Homework 5 Question 1 A PO and IO class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. What is the present value of the PO class if the discount/market rate is 11%? Excel is recommended for this problem. Answer Use excel to generate your table of cash flows. Remember: you are

...[Show More]

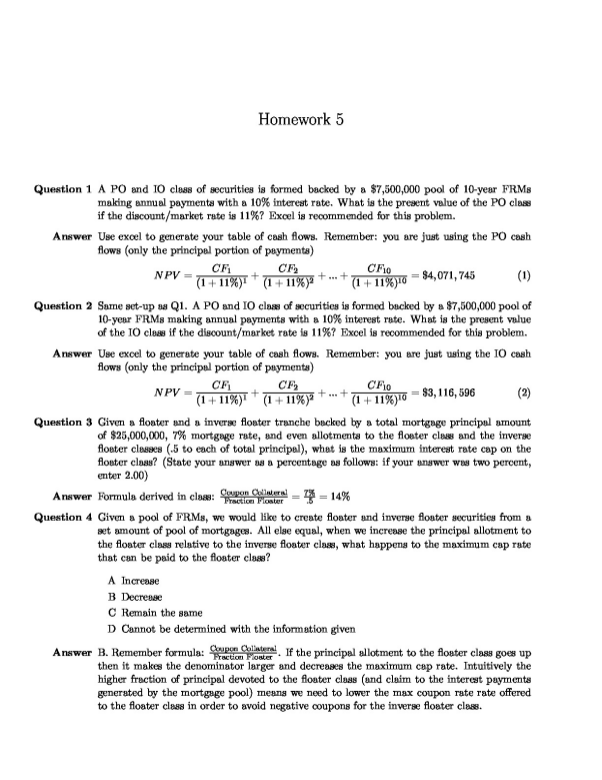

Homework 5 Question 1 A PO and IO class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. What is the present value of the PO class if the discount/market rate is 11%? Excel is recommended for this problem. Answer Use excel to generate your table of cash flows. Remember: you are just using the PO cash flows (only the principal portion of payments) NP V = CF1 (1 + 11%)1 + CF2 (1 + 11%)2 + ... + CF10 (1 + 11%)10 = $4, 071, 745 (1) Question 2 Same set-up as Q1. A PO and IO class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. What is the present value of the IO class if the discount/market rate is 11%? Excel is recommended for this problem. Answer Use excel to generate your table of cash flows. Remember: you are just using the IO cash flows (only the principal portion of payments) NP V = CF1 (1 + 11%)1 + CF2 (1 + 11%)2 + ... + CF10 (1 + 11%)10 = $3, 116, 596 (2) Question 3 Given a floater and a inverse floater tranche backed by a total mortgage principal amount of $25,000,000, 7% mortgage rate, and even allotments to the floater class and the inverse floater classes (.5 to each of total principal), what is the maximum interest rate cap on the floater class? (State your answer as a percentage as follows: if your answer was two percent, enter 2.00) Answer Formula derived in class: Coupon Collateral Fraction Floater = 7% .5 = 14% Question 4 Given a pool of FRMs, we would like to create floater and inverse floater securities from a set amount of pool of mortgages. All else equal, when we increase the principal allotment to the floater class relative to the inverse floater class, what happens to the maximum cap rate that can be paid to the floater class? A Increase B Decrease C Remain the same D Cannot be determined with the information given Answer B. Remember formula: Coupon Collateral Fraction Floater . If the principal allotment to the floater class goes up then it makes the denominator larger and decreases the maximum cap rate. Intuitively the higher fraction of principal devoted to the floater class (and claim to the interest payments generated by the mortgage pool) means we need to lower the max coupon rate rate offered to the floater class in order to avoid negative coupons for the inverse floater class. Question 5 Complete the blanks. In a PO/IO class, when interest rates go up, the value of the PO class goes and the value of the IO class goes . Assume the PO and IO class are supported by a mortgage pool with FRMs. A always; down; usually; up B never; down; never; up C usually; up; usually; down D always; down; always; do

[Show Less]

-preview.png)

-preview.png)